Know Your Number

A mantra to define your floor so you can build your future

Today in The Idea Bucket, we’re continuing our series on frameworks to help navigate your career. (You can also explore my growing library of frameworks on strategy and leadership.)

So far, we’ve made our Personal Selection Criteria, we’ve set our Go / No Go Date, we’ve started our Curiosity Tour, we are Creating Intentional Serendipity, and we are maintaining momentum with our Forwardable Emails.

But once these connections start to yield real opportunities, a new challenge emerges:

How do I value my time and services?

How do I think about pricing or salary?

Today, we get clear about how to think about money on your career journey.

You need to Know Your Number.

Maslow & Money

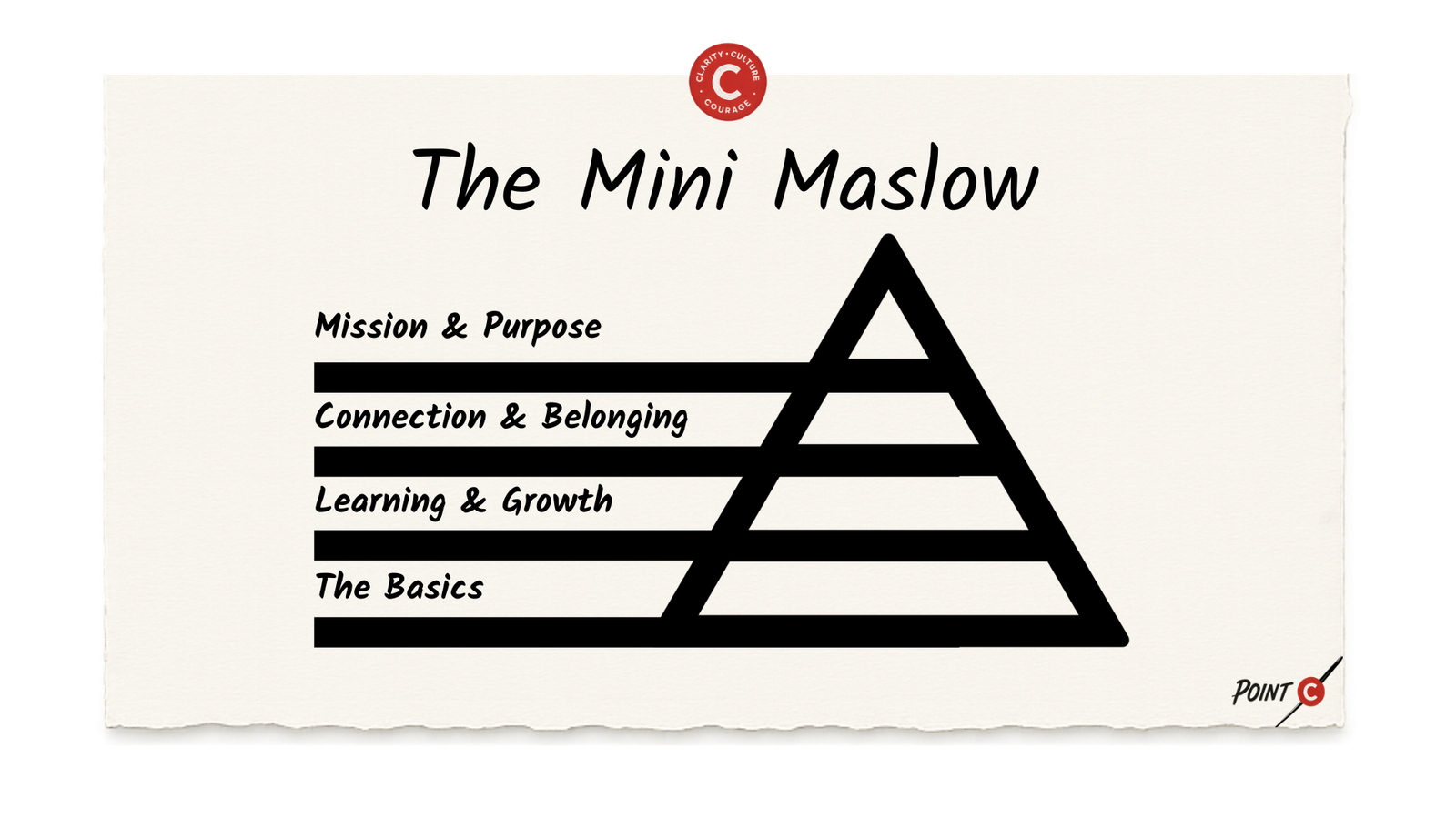

In The Personal Selection Stack, we defined your personal success criteria for the next chapter. A core part of that process was The Mini-Maslow, a brainstorm across four levels of the pyramid: The Basics, Learning & Growth, Connection & Belonging, Mission & Purpose.

Today, we're going to go deeper into one of The Basics that generates lots of feels: Money.

We all wonder:

- How much should I be paid?

- How should I price my services?

Some of us turn those shoulds into coulds:

- How much could I be paid?

- How could I price my services?

Some of us tie compensation to self-worth:

- Am I being taken advantage of?

- What does my pay say about my value as a human being?

This is a tricky subject. So today, I want us to focus on one essential foundation:

Before you can price your services or evaluate an offer,

you need to know your number.

Let’s build the foundation with some core negotiation principles first.

The Negotiator's Toolkit

Each year during the Sulzberger Program, I invite a Columbia Business School professor to teach negotiations fundamentals. I have had the privilege of learning from Professor Daniel Ames, Professor Shai Davidai, and, most recently, Professor Ashli Carter.

I’ve seen Sulzberger Fellows immediately apply their wisdom to business deals, salary negotiations, and personal decisions. So let’s establish a shared baseline:

You shouldn't go into a negotiation without first knowing the following:

- Your Plan B: In negotiations, this is known as your "BATNA" - your Best Alternative To A Negotiated Agreement. This is your power base. It answers the question: What will I do if I don't make a deal?

- Your Walkaway Point: In negotiations, this is known as your Reservation Point. This is the worst deal that you will accept. This is your rip cord. It answers the question: At what point do I walk away?

- Your Aspirational Goal: In negotiations, this is known as your Target Price. This is your ambitious but defensible goal. This is your aspiration. It answers the question: What do I actually want to achieve?

It's not just about knowing these key numbers, it's about how you approach the process:

- Prepare: This sounds simple but most people skip this part. You need to know what you really want, how much you value it, and in what priority. You need to know what your other options are and you need to know the various interests and options of the other party as well.

- Think In Packages: We tend to overlook that a negotiation is usually a package deal, not just about one variable. In career negotiations, salary is just one aspect of the package of interests you both have. Zoom out to understand the big picture.

- Remember It's A Repeat Game: When it comes to careers, most negotiations are not one-off events. It's the start of an ongoing relationship. Play the long game.

- Uncover Interests & Reveal Interests: Curiosity and empathy are your biggest superpowers in a negotiation. The more you can uncover the interests of the other party while revealing your own interests, the more opportunities for win-win-solutions. Help them help you.

- Grow The Pie Before You Slice It: By uncovering interests and talking in packages, you have an opportunity to create value between you. Only after you've created value should you try to claim value on any fixed sum issues.

This is the foundation. Now, let’s talk about what it means to Know Your Number. I want you to be able to look at it from two perspectives, that of an entrepreneur and that of an employee.

Your Entrepreneur Number

Some of my clients are launching service-based businesses, trying to unlock autonomy while replacing the stability of a full-time job.

One of the most common mistakes I see?

They don’t know their number.

They shrink themselves to what they think a client can afford. They undercharge, and in doing so, they fail to test a core business hypothesis:

Can I offer my services at a price that supports my sustainability goals?

To answer that, zoom out:

- Revisit your Go / No Go Date: How much revenue do you need to keep going?

- Go back to your Mini-Maslow: What's the minimum amount of cash you need to generate every month to meet your financial obligations?

- Define your aspirational goal: What income would make this path feel successful in two years?

This is quantifiable and it is personal. This is not based on what you think the market will support. This is not based on what your competition is charging. This is not based on what others will think is fair.

It’s based on your own goals. Start there. If you don’t know what success looks like, you won’t know how to test for it.

Doing the Actual Math

Let’s walk through a real example.

One entrepreneur I coached was launching his own technology coaching practice. He wanted to build a business that supported both client work and creative projects, and do so sustainably.

First, he determined what sustainability looked like for himself. He looked two years into the future and asked himself: How much would I need to be making each month to be excited about continuing down this path?

For him, that was $225,000 per year, which would replace his old salary plus benefits. He knew his monthly number: $18,750/month

Then, he had to figure out how to translate that monthly number into an equivalent hourly rate. This is where people tend to trip up. He could have just calculated it by assuming a 40-hour workweek. But he avoided that trap. Instead, he asked: How do I want to spend my time? What would an ideal work day, week, and month look like?

He concluded that he wanted to coach clients 4 days a week, every other week. He concluded he wanted to hit his sustainability target through coaching but he should leave time open for deep creative work on more risky projects. The ultimate goal was to produce assets that he could monetize independent of his time.

On his coaching days, he wanted to coach 3 clients in the morning, and 3 clients in the afternoon. That meant he had 6 slots a day, 24 slots a week, and 48 slots a month.

So the minimum price he needed to charge to prove his sustainability hypothesis was $18,750/48 =$390.

He now knew his number. It gave him confidence. He now had a clear walkaway point, and room to iterate above it.

How to Use Your Number

Let's answer some common questions:

- Is this the price I should charge? Not necessarily. Your price is also going to be influenced by what your clients are willing to pay and what alternatives they have.

- Should I charge by the hour? Not if you can help it. Value-based pricing is a better way to go. Ask: If this need gets solved, what is it actually worth to the client? Try to charge that. When you think about it, that rarely has anything to do with how many hours you put into it.

- Will my clients even pay that? You won’t know until you test. Just because this price unlocks your goal, doesn't mean the market will accept it. But the important thing is that you need to be able to test your sustainability hypothesis. I would rather you fail fast and learn now that your assumptions are wrong, rather than underprice yourself into unsustainability. And, if you don't test it, you will never know if your business is possible.

- What if my clients won't pay that? Then you don't have product-market fit. You are either offering the wrong product or you are offering it to the wrong type of client. It's time to iterate on the plan.

- So what does this number actually mean? It means that you should never value your time below your number. That's your walkaway point. You need to stick to that number to truly test if your model will work.

Here’s the bottom line:

Your number is the minimum price you place on your time.

You don’t have to reveal it, but you do have to know it.

Your Employee Number

Now let’s flip the lens. You’re evaluating a full-time role. What’s your number?

First, knowing your number means revisiting the criteria you generated for your Personal Selection Stack. I'm giving you a magic wand: If you had a job opportunity that would give you everything you were looking for, what is the minimum you would have to be paid to be able to say yes to that opportunity?

That’s your baseline number. It’s not about your ego or past salary. It’s about what you need at the base of Maslow’s hierarchy.

You will not consider any opportunities, however great they may be, below this line. But, as importantly, you will consider the right opportunities above this line. Because it's not just about salary, it's about the whole package.

This number will change over time, especially by life stage. Someone with few personal constraints and financial obligations has tremendous flexibility when it comes to their baseline number, which enables them to pursue opportunities that may maximize their learning and exposure, even at the expense of maximizing their current earning potential.

This was the case for me. When I was young, I had flexibility. A full ride to UNC gave me the freedom to take early-career risks that paid long-term dividends. But as I built a family and took on a mortgage, my number changed. My constraints became innovation drivers. I had to build the career that matched my life.

Where People Get Stuck

Whether entrepreneur or employee, avoid these traps:

- The Self Worth Trap: I am a big believer in people truly discovering their worth and a lot of my work is helping people realize that so much more is possible for them. However, I think it's a trap if you go into a salary negotiation thinking that this is an exercise that will determine your worth. If your self-worth is riding on what this company is willing to pay you, you've already lost. You've given away way too much agency and you are going to strangle the negotiation to death. Instead, I would shift from a focus on values to a focus on interests. What is this company interested in accomplishing and where do I fit in? What constraints are they operating under and what levers can and can't they pull? And, most importantly, have I explored other options that will increase my BATNA?

- The Other People's Self-Worth Trap: This is the most dangerous trap, especially if you are pricing by time. Some people might do back of the envelope math based on what your hourly rate is, and come up with an equivalent annual salary. They then do two things in their minds: 1) They ask themselves if they would hire you as a full-time employee at this rate. 2) They compare that salary to what they personally make and they have feelings about it. Ignore this. First, their math is wrong. (Don't forget they've skipped over all the things you don't get as a non-employee and they've made the mistake of thinking they could actually hire you in the first place.) Second, the value judgment on your number is their problem, not yours. Don't let others judge what you "deserve" to make based on their own circumstances.

- The Opportunity Cost Trap: Many full-timers forget: You could go out on your own. Now, that may be too scary to think about but it's a mistake to not have it your set of options. I can't tell you how many people I've coached who originally didn't realize that they not only could go out on their own, but they also might be making more money in the first year than they ever had. Remember that The Economic Theory of the Firm says that a salary is basically a risk-discounted version of your market value. When you join a firm, you accept a lower value for your services in exchange for reduced transaction costs. (Those are the things you are scared about doing yourself.) Not everybody can or should go out on their own, but if you succeed, you will be making more money than if you had stayed.

- The Benefits Trap: Along similar lines, most people overvalue company benefits because they view it abstractly and emotionally rather than concretely. I'm not saying the benefits are not important. They are essential. (And it's a bit crazy that in the American system our benefits tend to be tied to our jobs.) However, people never even consider going out on their own because they "need benefits from a company". But they haven't done the relatively easy work of pricing what it would actually cost to get those benefits on their own. An essential part of knowing your number is baking that benefits number into it. Yes, it might appear to make your number unreasonably high. But, oftentimes, people concretely look at it and they see a path that they hadn't seen before. Don't allow yourself to be shackled by invisible handcuffs. At least make them visible.

Your Challenge This Week

Figure out your number from both angles. Whether you are a salaried employee or an entrepreneur, you don't have a solid foundation until you truly know your number in both scenarios:.

1) First, put on the employee hat. Do the Personal Selection Stack Exercise if you haven't already: If you had a job opportunity that would give you everything you were looking for, what is the minimum you would have to be paid to be able to say yes to that opportunity? That's your employee number.

2) Second, put on the entrepreneur hat: What income would make my independent path feel successful in two years? Break that into a monthly cash flow target. That's your entrepreneur number.

3) As a bonus, design your ideal schedule. Translate your monthly number into an hourly minimum rate.

Now compare the two. What do they reveal? What possibilities do they unlock?

Next Week

We’ve made our Personal Selection Criteria, set our Go / No Go Date, started our Curiosity Tour, created Intentional Serendipity, maintained momentum with Forwardable Emails, and now we've done the work to Know Your Number.

Next week, we'll get ahead of a phenomena that causes job hunters to lose control of their identity and their requirements for success during job interviews: Avoid The Pretzel Trap

About This Newsletter

The Idea Bucket is a weekly newsletter and archive featuring one visual framework, supporting one act of leadership, that brings you one step closer to building a culture of innovation.

It’s written by Corey Ford — executive coach, strategic advisor, and founder of Point C, where he helps founders, CEOs, and executives clarify their visions, lead cultures of innovation, and navigate their next leadership chapters.

Want 1:1 executive coaching on this framework or others? Book your first coaching session. It's on me.